Now that you know what salvage value means, let’s discover ways to calculate salvage value. Understand the concept of salvage worth in accounting, its calculation, and its impact on monetary statements and tax reporting. Enter the unique worth, depreciation fee, and age of the asset into the software to calculate its salvage value. The calculator will compute the remaining value after depreciation based on the offered how to calculate salvage value of an asset inputs. And the depreciation fee on which they will depreciate the asset would be 20%.

Salvage Worth Calculation

Regular audits and evaluations are needed to ensure compliance, as sturdy auditing capabilities verify all asset transactions are precisely recorded. Taking these components into account helps correct monetary portrayals and maintains stakeholder belief. Useful life refers to the anticipated time an asset will be productive for a enterprise. This interval varies based mostly on factors like asset kind, industry requirements, and technological developments.

Depreciation Strategies Involving Salvage Worth

Let’s say the company assumes each automobile could have a salvage worth of $5,000. This means that of the $250,000 the corporate paid, the company expects to recuperate $40,000 at the finish of the helpful life. There could additionally be a little nuisance as scrap worth might assume the great isn’t being sold but as an alternative being converted to a raw materials. For example, a company may resolve it needs to simply scrap a company fleet automobile for $1,000. This $1,000 may also be considered the salvage worth, though scrap worth is slightly extra descriptive of how the corporate could get rid of the asset.

A depreciation schedule helps you with mapping out monthly or yearly depreciation. Therefore, a car with even a couple of miles driven on it tends to lose a major share of its initial worth the moment it becomes a “used” automotive. All information https://www.kelleysbookkeeping.com/ is topic to particular circumstances | © 2025 Navi Restricted (formerly known as Navi Applied Sciences Ltd). Subsequently, Company A would depreciate the machine at the amount of $16,000 annually for 5 years.

3 Transmission Line Financial Life Interval Outcomes

- With AI-powered techniques, companies can automate asset monitoring, predict put on and tear, and estimate end-of-life value extra precisely.

- It’s additionally useful for guessing how much money they might make after they eliminate it.

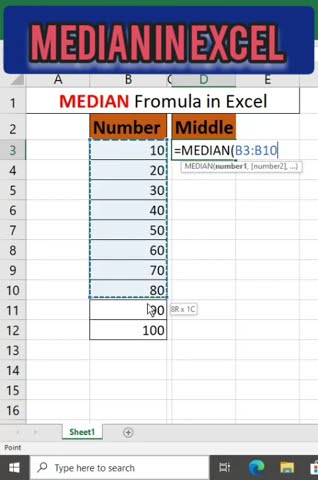

- Enter the original value, depreciation price, and age of the asset into the device to calculate its salvage worth.

- The carrying worth of the asset is then decreased by depreciation each year in the course of the useful life assumption.

Buyers and managers think about salvage value to assess whether or not an acquisition will yield profitability or if a special investment would possibly supply better returns. An accurate estimation of salvage value, alongside liabilities assessment, is pivotal in figuring out the true equity generated from transactions. Salvage worth, also referred to as scrap worth, is the worth of a particular asset after its useful life.

1 Information

As A Substitute of a fixed annual cost, depreciation varies with the asset’s operational output, like machine hours or items produced. It uses the straight-line percentage on the remaining value of the asset, which outcomes in a bigger depreciation expense within the earlier years. Some methods make the item lose extra worth initially (accelerated methods), like declining steadiness, double-declining stability, and sum-of-the-years-digits. The depreciable amount is like the entire loss of worth after all the loss has been recorded. The carrying worth is what the merchandise is value on the books as it’s shedding worth.